Unlock the Full Potential of Your OrangeNXT Account with Video Verification

At OrangeNXT, we believe in empowering our users with the best tools to manage their finances seamlessly. To unlock all the features and benefits of your OrangeNXT account, performing Video Verification is a mandatory step. This process ensures your account’s security, reduces the risk of fraud, and helps us stay compliant with the regulations.

If you haven’t completed your Video KYC yet, here’s why it matters, how you can do it, and answers to common questions to guide you through the process.

Why Perform Video KYC?

Completing your Video KYC allows you to:

1. Remove Transaction Limits and Account Validity Restrictions

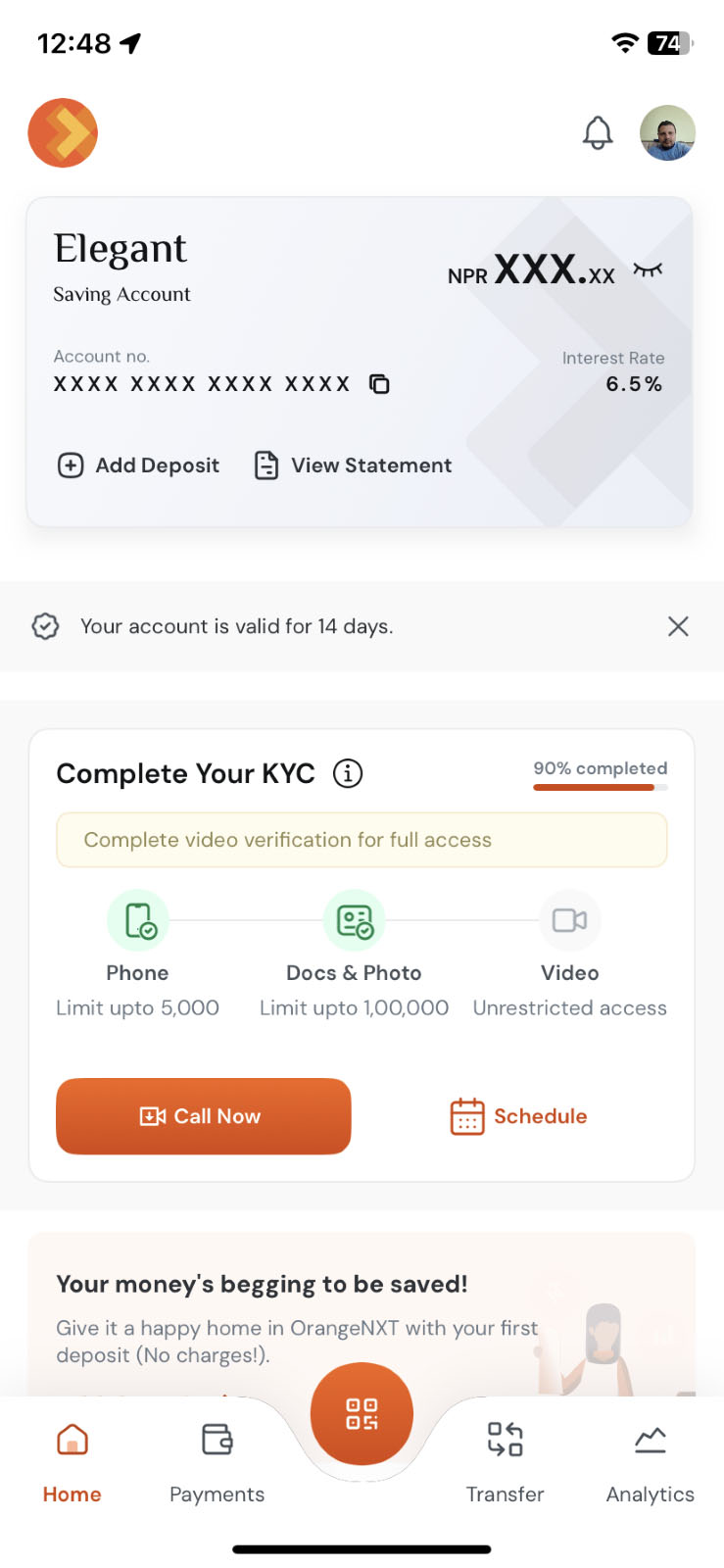

- Without Video KYC, your OrangeNXT account comes with limitations:

- Transaction Limit: Your transactions are capped upto Rs. 5,000 or Rs. 1,00,000

- Account Validity: Your account is valid for only 15 to 30 days.

- Once you perform Video KYC, these restrictions are lifted, enabling seamless financial transactions.

2. Access Exclusive Savings Features

- Goal-Based Deposit: Save for specific goals like travel, education, or emergencies.

- Smart Budget: Track your spending and get personalized financial insights.

- Save As You Pay: Automatically save small amounts with every transaction.

3. Stay Compliant

- Video KYC ensures your account complies with the regulations set by Nepal Rastra Bank while ensuring your safety and security.

How to Perform Video KYC?

Completing Video KYC on OrangeNXT is easy and can be done in a few simple steps:

Step 1: Access the Dashboard

- Open your OrangeNXT app.

- Navigate to the Dashboard.

Step 2: Start the Video Call

- Click on the "Call Now" button to connect with an operator instantly.

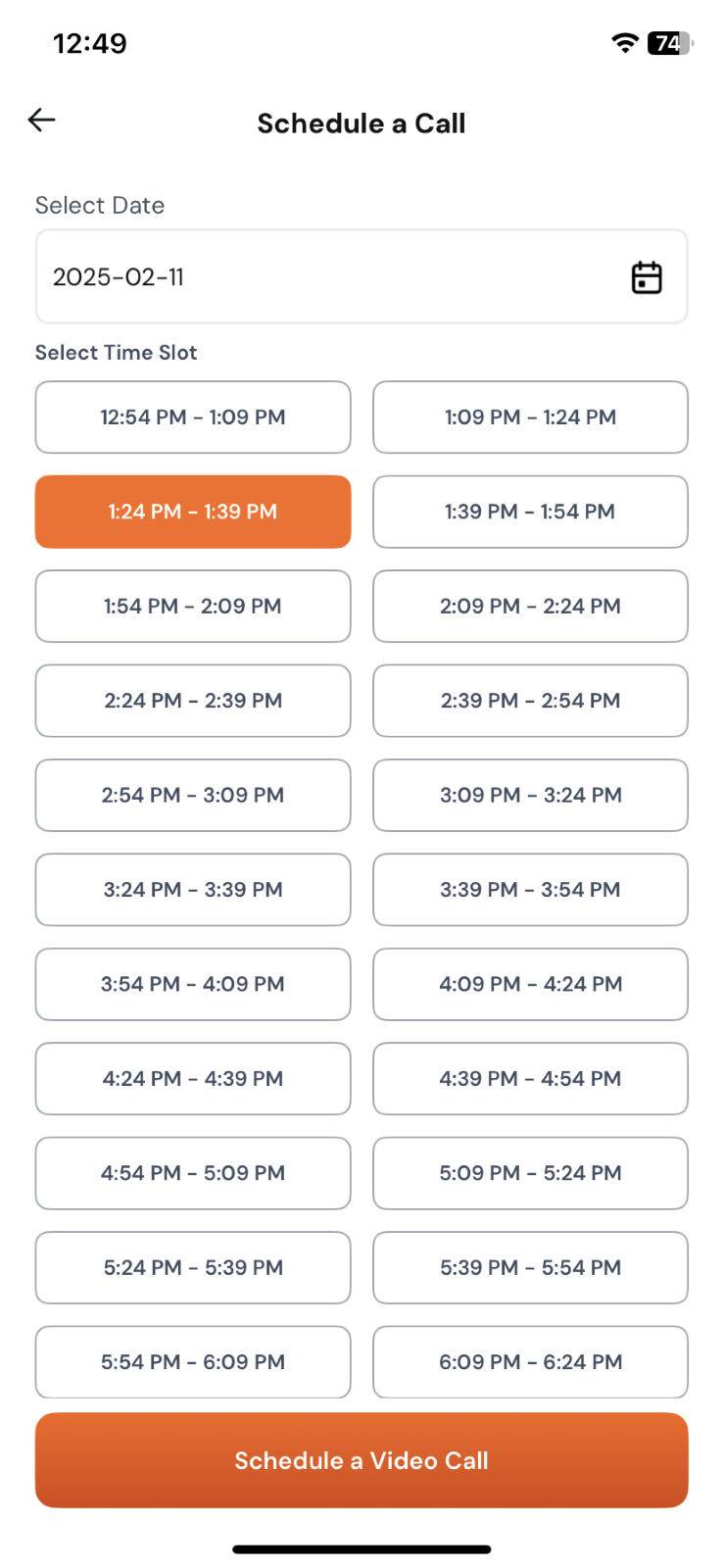

Step 3: Schedule a Call (Optional)

- If you’re busy, you can schedule a video call at a time that suits you. Please note that you can cancel or reschedule anytime.

Step 4: Complete the Video KYC Process

- During the video call, the operator will:

- Verify the details on your provided documents.

- Ask questions about the purpose of your account.

- Conduct general inquiries as mandated by Nepal Rastra Bank.

- The process takes just a few minutes and ensures your account is fully activated.

FAQs: All You Need to Know About Video KYC

Before starting Video call, please make sure:

- You are 18 years or older

- You are in a well lit place

- You have a strong and stable internet connection

- You have Government ID in hand

- You yourself are present in the video and not represented by anyone else

1. What is Video KYC?

Video KYC is a video-based process that verifies your identity and account details to comply with banking regulations and secure your account.

2. Why is Video KYC Mandatory?

Nepal Rastra Bank mandates Video KYC to ensure transparency, security, and compliance with banking regulations. Without completing Video KYC, your account will remain restricted.

3. How Long Does Video KYC Take?

The process typically takes 5 to 10 minutes, depending on the accuracy of your submitted documents.

4. What Documents Do I Need for Video KYC?

You’ll need:

- A valid government-issued ID (e.g., Citizenship Certificate, Passport, Driving License, National ID)

- Provided document should be valid and not expired

- Work permit document (in case of Remittance account)

- Please make sure the details in the documents are readable

5. What Questions Will Be Asked During the Video Call?

The operator will ask:

- To confirm details on your submitted documents.

- The purpose of your OrangeNXT account and your source of income (e.g., savings, transactions).

- General questions to verify your identity.

6. Can I Schedule the Video KYC Call?

Yes! If you’re unavailable, you can schedule a call at your convenience directly from the dashboard.

7. What Happens If I Don’t Complete Video KYC?

If you don’t perform Video KYC:

- Your account will have a transaction limit.

- Your account will expire after 15 to 30 days.

- You won’t have access to savings features like Goal-Based Deposit, Smart Budget, and Save As You Pay.

8. Is the Video KYC Process Secure?

Absolutely. The process is encrypted and compliant with all banking regulations to ensure your data is safe.

9. What will be my account limit, and how many transactions can I do?

Once your Video Verification is successfully completed all the transaction limit will be removed. However, mobile banking limit mandated by NRB will be applicable. Current limit stands at

| Daily limit | Debit only | Rs. 3,00,000 |

| Monthly limit | Debit only | Rs. 30,00,000 |

10. What Happens If My Video Verification Is Disapproved?

If your Video Verification is disapproved:

- Double-check your submitted documents for clarity and accuracy.

- Ensure that you have followed all instructions during the video call.

- Contact our support team for assistance to resolve the issue and retry the process.

11. What If I Am Outside Nepal?

If you are outside Nepal, you can still perform Video Verification as long as you have the required documents with you. Simply log in to the OrangeNXT app, navigate to the dashboard, and initiate the video call or schedule a call at a convenient time.

12. What is the timing for VKYC?

Our Video Verification service is available 24/7. You can call anytime you're free.

Benefits Recap: Why Complete Your Video KYC Today?

| Without Video KYC | With Video KYC |

| Account validity: 15-30 days | Unlimited account validity |

| Transaction limits in place | No transaction limits (Mobile banking limits apply as per NRB) |

| Limited features | Access to all savings tools |

| Compliance pending | Fully compliant and secure |

Don’t wait! Complete your Video KYC today to enjoy a seamless banking experience.

Need Help?

If you have any questions or need assistance, our support team is here to help:

- Phone: +977 01-5970974

- Viber/WhatsApp: 9704540331

- Email: [email protected]

Experience the full power of OrangeNXT with Video KYC—your gateway to better banking!

For the ones who are always excited about what's next...

Get ready to join The ORANGE Revolution

Scan to download our app.

Enjoy 100% digital banking experience at your fingertips.